Utility service areas significantly impact buyers' costs and borrowing experiences, with variations based on geographical location. Urban areas offer more options and lower rates compared to rural regions due to infrastructure differences. Lenders analyze these maps to assess risk, resulting in varied loan terms and interest rates. Buyers can leverage this knowledge to make informed decisions about relocation or negotiating better terms. Policymakers and lenders can use detailed maps for equitable access to financial resources, especially in underserved communities. Key strategies to optimize utility service areas include improving network coverage, adopting smart grid technologies, implementing transparent pricing models, and promoting energy conservation.

In today’s economy, understanding the intricate relationship between utility service areas and buyer costs is more vital than ever. The impact of these regional variations on lending trends has become a complex web, affecting individuals’ financial decisions and access to capital. This article aims to dissect this intricate dynamic, offering an authoritative analysis that illuminates how changes in utility service areas naturally influence borrowing costs for buyers across different sectors. By exploring these trends, we empower stakeholders with insights crucial for making informed economic policy decisions and strategic business moves.

Understanding Utility Service Areas: Buyer Behavior Impact

Utility service areas play a pivotal role in shaping buyers’ costs and their overall experience with essential services. These areas, often represented by detailed coverage maps, delineate geographical boundaries within which utility providers offer their services. Understanding the intricacies of these maps is crucial for both buyers and lenders as it directly influences purchasing decisions and financial obligations.

Within specific utility service areas, buyers may encounter varying levels of competition among providers, leading to differing price points for identical services. For instance, electricity in densely populated urban areas often enjoys a more competitive market, potentially resulting in lower rates for residents compared to rural regions where options are limited. This dynamic is reflected in lending trends; buyers in diverse utility service areas exhibit distinct borrowing patterns and cost implications. Lenders must consider these geographical variations when assessing borrower eligibility and offer tailored financial products accordingly.

Coverage maps of utility service areas provide valuable insights into market segmentation and potential buyer behavior. For lenders, analyzing these maps allows for more precise risk assessment and product customization. By understanding the density and distribution of utility providers in a given region, they can anticipate borrowing behaviors and adjust their lending strategies. Moreover, buyers can leverage this knowledge to make informed decisions about relocating or negotiating better terms with existing service providers, thereby reducing costs associated with utilities over time.

Lending Trends: Unraveling Cost Connections

Lending trends offer a compelling window into how utility service areas subtly shape buyer costs. As financial institutions meticulously analyze geographic data to create risk profiles, variations in utility service areas coverage maps can lead to significant differences in loan terms and interest rates. For instance, regions with comprehensive utility infrastructure, as indicated by detailed coverage maps, often enjoy lower borrowing costs due to the reduced perceived risks associated with stable access to essential services. Conversely, areas with patchy or outdated utility service areas may face higher lending barriers, reflecting the potential for increased maintenance expenses and service interruptions.

These trends underscore the profound impact of infrastructure on economic opportunities. Communities benefiting from robust utility service areas can foster stronger local economies, attracting businesses and encouraging investment. Conversely, regions lacking adequate utilities may struggle to compete, leading to reduced access to credit and limited growth prospects. Understanding these connections is crucial for policymakers and lenders alike, as it allows for targeted interventions aimed at promoting equitable access to financial resources, especially in underserved communities where utility service areas coverage maps might reveal gaps in critical infrastructure.

Practical insights emerge from this analysis. Lenders can leverage detailed utility service area maps to refine their lending strategies, enabling them to offer more tailored and accessible credit options. For borrowers, being aware of these trends empowers them to compare loan terms transparently. By examining the utility service areas coverage in potential investment or residence locations, individuals can make informed decisions about their financial commitments, ultimately navigating the complex landscape of buyer costs with greater expertise.

Analyzing Geographical Disparities in Utilities

The cost of utilities is a significant factor influencing buyers’ decisions, often representing a substantial portion of monthly expenses. Geographical disparities in utility service areas play a pivotal role in shaping these costs, leading to notable variations across regions. These differences stem from factors such as infrastructure investment, climate, and regulatory frameworks, all of which are reflected in the availability and pricing of essential services like electricity, water, and gas.

Utility service area coverage maps offer a compelling visual representation of these disparities. For instance, rural areas often face higher utility costs due to limited infrastructure and longer distances for resource transmission. In contrast, urban centers benefit from economies of scale and advanced grid systems, resulting in potentially lower rates. Consider the case of electricity prices; data indicates that rural households in certain states pay 15-20% more for electricity than their urban counterparts, primarily attributed to the extended network requirements. This geographical divide is further amplified by climate considerations; regions with extreme temperatures require more robust heating or cooling systems, thereby increasing utility expenditures.

To navigate these disparities, buyers can employ strategic approaches. One practical advice is to research and compare utility service areas when considering a move. Utilizing online tools and coverage maps allows individuals to gauge the potential costs associated with their desired location. Additionally, staying informed about local regulatory changes and industry innovations can empower buyers to make more informed decisions. For instance, some regions are adopting renewable energy sources, which could lead to more competitive pricing over time. Understanding these dynamics is essential for buyers aiming to optimize their long-term utility expenses within a given utility service area.

Financial Implications for Borrowers in Different Areas

Utility service areas play a significant role in shaping buyers’ costs through varied lending trends across different regions. The financial implications for borrowers can be substantial, influenced by factors such as access to credit, local market conditions, and regulatory frameworks within specific utility service areas. For instance, consumers in urban centers with extensive utility service area coverage maps often enjoy more competitive loan options due to higher demand for property and a well-established financial ecosystem. These areas typically attract multiple lenders, driving down interest rates and fees.

In contrast, borrowers in rural or underserved regions may face unique challenges. Limited utility service area coverage can result in fewer lending institutions operating within the region, leading to reduced competition. Consequently, loan products might be less diverse, with higher interest rates and less flexible terms. Data from recent studies indicates that areas with sparse financial services infrastructure often have significantly higher borrowing costs for residents, impacting their ability to invest in property or access capital for business ventures.

To navigate these disparities effectively, borrowers should employ strategic approaches tailored to their utility service area. Proactive research into local lending trends and comparing offers from multiple lenders can help secure favorable terms. Additionally, exploring alternative financing options or partnering with community development financial institutions (CDFFIs) that focus on underserved utility service areas may offer more accessible and affordable loan opportunities. By understanding the unique dynamics of their region’s utility service area coverage maps, borrowers can make informed decisions to optimize their financial outcomes.

Strategies to Mitigate Cost Variations in Utility Services

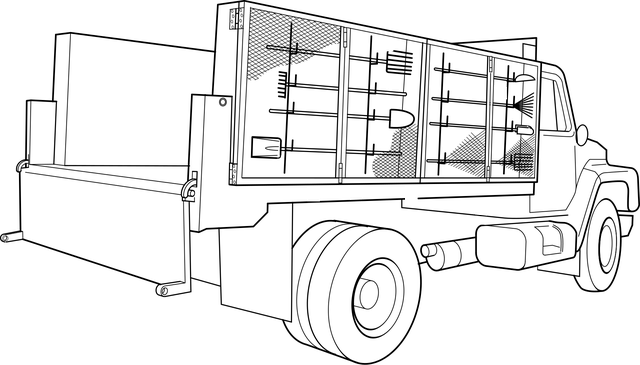

Utility service areas play a pivotal role in shaping buyers’ costs, with lending trends offering valuable insights into these dynamics. To mitigate cost variations in utility services, a strategic approach is essential. One effective strategy involves analyzing and optimizing the coverage of utility networks within specific geographic regions. By studying utility service area maps, lenders and policymakers can identify gaps or areas of concentrated need, leading to more equitable access and pricing.

For instance, consider a scenario where a new housing development is planned in an area with limited electricity infrastructure. Lenders can collaborate with utilities to expand coverage through strategic investments. This proactive approach not only ensures reliable utility services for new residents but also stabilizes costs by distributing infrastructure expenses over a larger customer base. Furthermore, implementing smart grid technologies and leveraging data analytics can optimize energy distribution, reducing waste and enhancing cost efficiency across utility service areas.

Another crucial aspect is transparent pricing models. Lenders should encourage utilities to adopt dynamic pricing structures that reflect real-time demand and supply conditions. This strategy ensures fairer rates for consumers during peak and off-peak periods, as evidenced by successful pilot projects in several cities. Additionally, promoting energy conservation programs through incentives and education can empower consumers to manage their consumption patterns, further stabilizing costs within utility service areas.